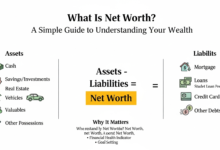

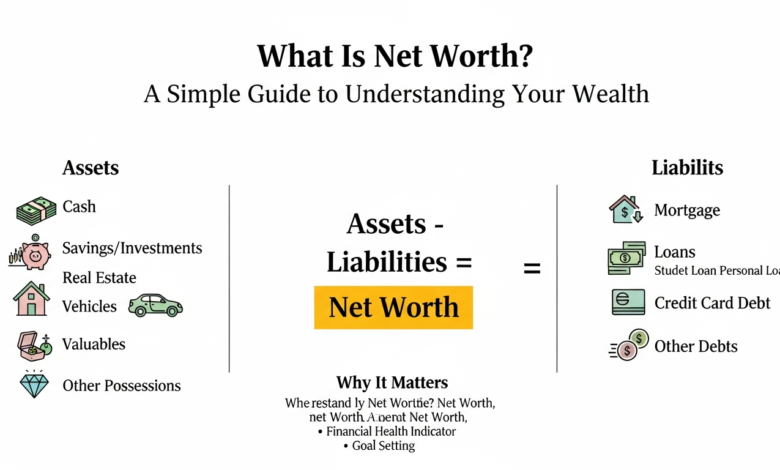

What Is Net Worth? A Simple Guide to Understanding Your Wealth

When you hear the term What Is Net Worth, you might wonder what it really means. Simply put, net worth is the value of everything you own minus everything you owe. It’s a way to see how much money you would have if you sold all your stuff and paid off your debts.

Knowing your net worth is important because it helps you understand your financial health. It’s like a financial report card showing your money’s strength. This article will explain what net worth is, how to calculate it, and why it matters in everyday life.

What Does Net Worth Mean?

Net worth is the difference between your assets and liabilities. Assets are things you own, like your house, car, savings, or investments. Liabilities are the debts or money you owe, such as loans, credit card bills, or mortgages.

For example, if you have $10,000 in your bank and a car worth $5,000 but owe $7,000 on a loan, your net worth would be:

$10,000 + $5,000 – $7,000 = $8,000

So, your net worth is $8,000. This number can be positive or negative depending on your financial situation.

How to Calculate Your Net Worth Easily

Calculating net worth is simple. Just follow these steps:

- List all your assets with their current values.

- List all your debts or liabilities.

- Subtract your liabilities from your assets.

Use a notebook or a spreadsheet to keep track. Updating it regularly helps you watch your progress.

Why Is Net Worth Important?

Your net worth gives you a clear picture of your money situation. It helps you:

- Understand your financial strength.

- Plan for big purchases like a house or car.

- Set goals for saving and investing.

- Track progress over time.

If your net worth is growing, you’re moving in the right direction. If it’s shrinking, it might be time to rethink your spending or saving habits.

Assets: What Counts Toward Your Net Worth?

Assets include anything valuable that you own. Common examples are:

- Cash in your bank accounts

- Investments like stocks and bonds

- Property such as a house or land

- Personal items like cars, jewelry, or collectibles

It’s important to list assets at their current market value, not what you paid for them.

Liabilities: What Debts Affect Your Net Worth?

Liabilities are your debts and obligations. They reduce your net worth because you owe this money to others. Examples include:

- Mortgage loans

- Car loans

- Credit card balances

- Student loans

- Personal loans

Always keep track of your liabilities to see their impact on your finances.

How Often Should You Check Your Net Worth?

Many experts recommend checking your net worth at least once a year. However, if you want to be more careful with your money, checking every 3 to 6 months can help you stay on track.

Regular updates let you see changes and adjust your budget or savings goals quickly.

Net Worth vs Income: What’s the Difference?

People often confuse net worth with income, but they are not the same. Income is the money you earn, like your salary or wages. Net worth is what you own minus what you owe.

You can have a high income but low net worth if you spend more than you save. On the other hand, you can have a low income but high net worth if you save and invest wisely over time.

Real-Life Example of Net Worth

Let’s take Sarah’s example. She has a house worth $150,000, a car worth $10,000, and savings of $20,000. She owes $100,000 on her mortgage and $5,000 on her credit card.

Sarah’s net worth:

$150,000 + $10,000 + $20,000 – $100,000 – $5,000 = $75,000

Sarah’s net worth shows she owns more than she owes, which is a good financial position.

How to Improve Your Net Worth

Improving your net worth is about increasing assets and reducing liabilities. Here are simple ways to do it:

- Save more money regularly.

- Pay off debts faster.

- Invest in stocks, bonds, or property.

- Avoid unnecessary spending.

- Increase your income by learning new skills or side jobs.

Even small changes can add up to a big difference over time.

Common Mistakes to Avoid When Calculating Net Worth

Many people make mistakes calculating net worth by:

- Overestimating asset values.

- Ignoring some debts.

- Forgetting about retirement accounts.

- Not updating the calculation regularly.

Be honest and careful for the most accurate net worth number.

The Role of Net Worth in Financial Planning

Financial planners use net worth to help clients make smart money decisions. It guides budgeting, retirement plans, and investments. Knowing your net worth is the first step to setting realistic financial goals.

What Is a Good Net Worth?

There is no one-size-fits-all answer. A good net worth depends on your age, income, location, and goals. Younger people often have lower net worths because they are still paying off school loans or starting careers. Older adults usually have higher net worths due to savings and investments.

Frequently Asked Questions (FAQs)

1. How often should I update my net worth?

Check it every 3 to 12 months to track your progress.

2. Can net worth be negative?

Yes, if your debts are more than your assets, your net worth is negative.

3. Does net worth include retirement accounts?

Yes, retirement savings are part of your assets.

4. How does debt affect net worth?

Debt lowers your net worth because it’s money you owe.

5. Can net worth grow without earning more income?

Yes, by saving, investing, or reducing debt.

6. Is net worth the same as wealth?

Net worth is a measure of wealth but doesn’t always show full financial health.

Conclusion

Understanding what is net worth is a key step toward better money management. It gives you a clear view of your financial situation and helps you plan for the future. Start by calculating your net worth today, then use that knowledge to save, invest, and reduce debt. Your money story is in your hands—take control and watch your net worth grow!