Understanding JEPQ Dividend History: A Simple Guide for Investors

JEPQ dividend history is an important topic for anyone who wants to invest wisely. Knowing the past dividends of JEPQ helps investors see how the fund has paid money over time. This information can show whether the fund is reliable and if it can give regular income. People who want steady returns often look at dividend history before making decisions. JEPQ is known for its focus on quality stocks that pay dividends. By studying its dividend history, you can understand patterns and trends in payments. You also learn how external market changes can affect dividend amounts. Investors can use this knowledge to plan their investments better and choose the right time to buy or sell shares.

Looking at JEPQ dividend history also helps in comparing it with other similar funds. This comparison makes it easier to know if JEPQ is a strong choice for long-term income. Dividends are more than just money; they show the fund’s health and management quality. By tracking dividend growth or cuts, investors can predict future performance and manage risk. For beginners, understanding this history may seem tricky, but it is simpler when broken down into clear points. JEPQ dividend history can guide you in making smart decisions for retirement plans, savings growth, or building a balanced portfolio. In short, past dividends are a window to future opportunities.

What is JEPQ Dividend History and Why It Matters

JEPQ dividend history shows how much money the fund has given to its investors over time. Dividends are like rewards for investing in the fund. By checking this history, investors can see if the fund is consistent in paying dividends. Regular dividends mean the fund is healthy and managed well. For new investors, this history helps to understand how much income they can expect.

Knowing the JEPQ dividend history also helps in planning finances. If the fund has a steady record of paying dividends, it becomes a reliable option for income. Investors can plan for short-term needs, like monthly expenses, or long-term goals, like retirement. The history also reflects the fund’s ability to handle market ups and downs. In simple words, dividend history is a key tool for safe investing.

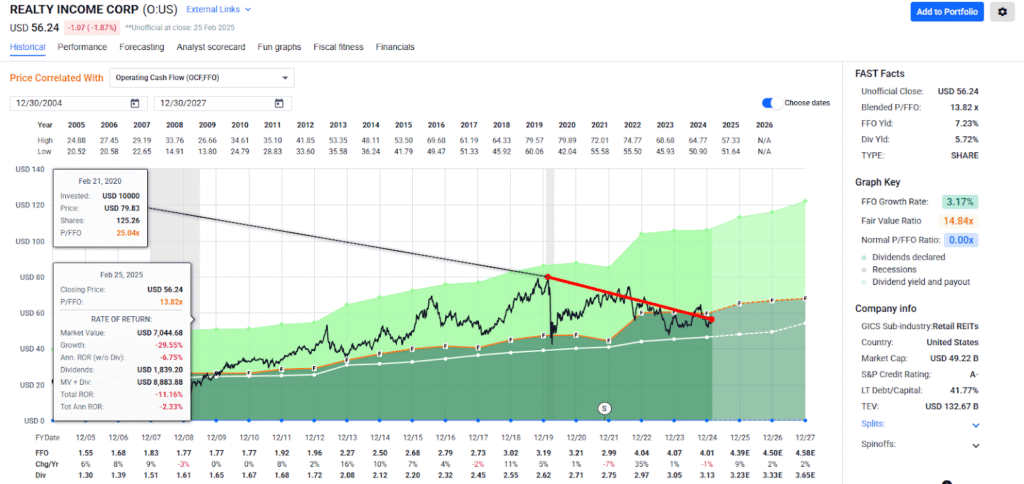

How JEPQ Dividend History Shows Fund Performance

JEPQ dividend history is not just about money; it shows how the fund performs over time. Funds that grow their dividends regularly usually have strong management and good stock choices. Investors look at dividend trends to see if the fund can continue paying in the future.

Performance is also seen in consistency. If the dividend history shows regular payments every quarter or year, it indicates stability. Funds with erratic or decreasing dividends may have underlying problems. Checking the dividend history alongside other metrics like fund growth can give a complete picture. JEPQ dividend history helps investors judge if the fund is worth keeping in their portfolio.

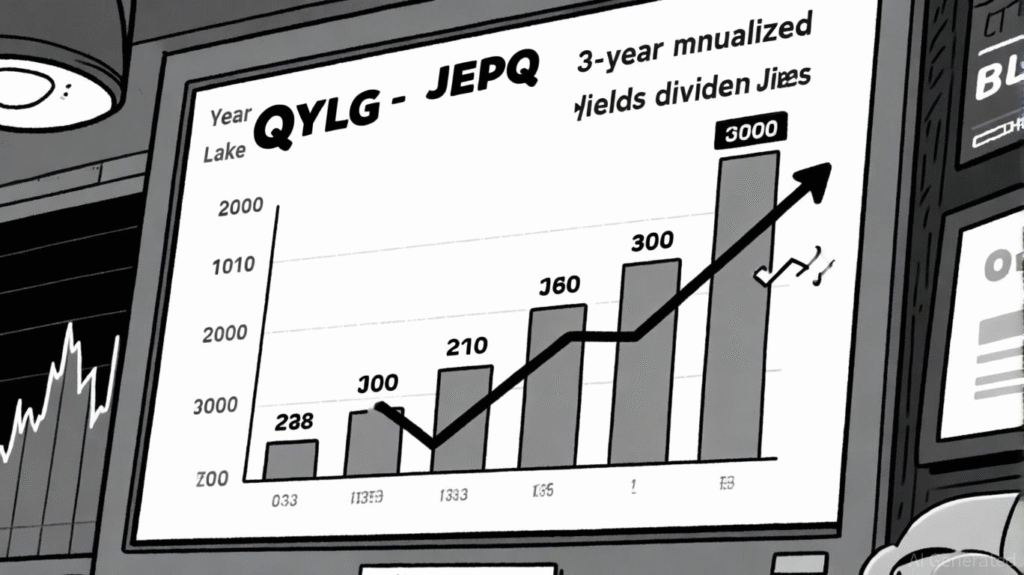

Top Years for JEPQ Dividend Payments

Some years in JEPQ dividend history stand out because the fund paid more money. These top years often happen when the stock market performs well or when the fund earns extra income. Investors study these years to understand what affects dividends.

For example, if dividends grew in a certain year, it might be because of strong earnings from the fund’s stocks. On the other hand, lower dividends may happen in weak market years. Knowing these patterns helps investors manage expectations. Tracking top years also guides long-term planning for income and reinvestment strategies

Understanding Patterns in JEPQ Dividend History

Looking at JEPQ dividend history carefully can reveal patterns. Some funds increase dividends steadily, while others pay the same or reduce them during hard times. These patterns help investors predict future income.

For instance, if JEPQ consistently raised dividends each year, investors can expect growth in their income. But if there are ups and downs, it may be wise to keep some money as a buffer. Understanding these patterns is important for anyone who depends on dividends for living or retirement. It also helps in comparing JEPQ with other funds for better investment decisions.

Monthly vs Quarterly Dividends in JEPQ Dividend History

JEPQ pays dividends at set intervals, usually quarterly. Some investors prefer monthly dividends for steady cash flow, while others are fine with quarterly payments. JEPQ dividend history shows how often payments happen and how much is given each time.

Quarterly dividends mean investors get payments four times a year. This is good for those who want regular income but do not need it every month. By checking the dividend history, investors can plan their spending or reinvestment. Understanding payment frequency is an important part of using JEPQ dividend history for smart financial planning.

How Market Changes Affect JEPQ Dividend History

Market conditions play a big role in JEPQ dividend history. Strong markets often lead to higher dividends, while weak markets may reduce them. Investors need to understand that dividends depend not just on the fund but also on external factors.

For example, economic recessions, interest rate changes, or market crashes can affect dividends. By studying JEPQ dividend history, investors can see how the fund responded in past market challenges. This knowledge helps prepare for the future and manage risk better. History shows the resilience of the fund and its ability to continue rewarding investors even during tough times.

Comparing JEPQ Dividend History with Other Funds

Investors often compare JEPQ dividend history with other similar funds. This comparison helps to know which fund is better for regular income. Funds with higher and more consistent dividends usually attract more investors.

By looking at the dividend history, one can see how JEPQ stands against competitors. If JEPQ shows stable growth while others have fluctuations, it becomes a safer choice. Comparing also helps in building a diversified portfolio with multiple dividend-paying funds for steady income.

JEPQ Dividend History: Insights for Long-Term Investors

Long-term investors use JEPQ dividend history to plan for years ahead. Consistent dividends can be reinvested to grow wealth. The history provides clues about future trends, helping investors make informed decisions.

For example, a steady dividend history may indicate that the fund will continue paying for decades. This makes JEPQ a strong option for retirement savings or long-term income generation. Investors can rely on history to see how the fund handled past challenges and how it may perform in the future.

How JEPQ Dividend History Helps in Retirement Planning

Retirement planning depends on predictable income, and JEPQ dividend history provides that insight. By knowing how much dividends were paid in the past, investors can estimate future income.

For retirees or soon-to-be retirees, this is very useful. They can plan how much to save, when to buy shares, and how to use dividend income for daily expenses. JEPQ dividend history helps in making retirement secure and less stressful.

Tips for Using JEPQ Dividend History to Make Smart Investments

- Track dividend trends over multiple years.

- Compare with other funds before investing.

- Consider market conditions that affected dividends.

- Reinvest dividends to grow wealth over time.

- Use dividend history to plan short-term and long-term income.

These tips help investors make smart decisions using JEPQ dividend history. Simple tracking and understanding of trends can improve financial outcomes.

Common Mistakes Investors Make Ignoring JEPQ Dividend History

Some investors ignore JEPQ dividend history and rely only on fund growth. This can be risky because dividend income is an important part of total returns. Others may assume past dividends guarantee future payments, which is not always true.

By ignoring history, investors may face surprises during market downturns or unexpected dividend cuts. Learning from the past helps in avoiding mistakes and making informed investment choices.

Future Outlook Based on JEPQ Dividend History

Looking at JEPQ dividend history, the future seems promising for steady income. If trends continue, investors can expect consistent dividends. Future payments may increase as the fund grows and markets improve.

Investors should keep monitoring history alongside fund performance. This ensures better decisions for reinvestment, portfolio balance, and income planning. History is a guide, not a guarantee, but it provides valuable insight for confident investing.

Conclusion

JEPQ dividend history is a powerful tool for investors. It shows past performance, helps predict future income, and guides financial planning. By studying this history, investors can make smart choices for long-term growth and retirement. Paying attention to patterns, market effects, and consistency ensures better investment decisions. JEPQ dividend history is not just numbers; it is a roadmap for secure and steady income.

FAQs

Q1: What is JEPQ dividend history?

A: JEPQ dividend history shows the record of dividends paid by the fund over time. It helps investors see past income and plan for the future.

Q2: How often does JEPQ pay dividends?

A: JEPQ usually pays dividends quarterly, meaning four times a year.

Q3: Can past dividend history predict future dividends?

A: It gives insights but does not guarantee future dividends. Market conditions and fund performance can affect payments.

Q4: Why is dividend history important for retirement planning?

A: It helps estimate future income, plan spending, and make informed investment choices for steady retirement income.

Q5: Should I compare JEPQ dividend history with other funds?

A: Yes, comparing helps choose the best fund for reliable income and to build a balanced portfolio.