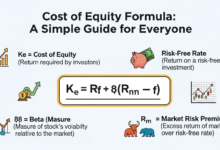

Cost of Equity Formula: A Simple Guide for Everyone

When businesses want to grow, they need money. This money can come from different places like loans or investors. The cost of equity formula helps companies figure out how much it costs to get money from investors by selling shares. It is a way to know the price of using people’s money.

If you want to understand how companies decide what to pay their investors, this guide will help. We’ll explain the cost of equity formula step by step in a simple way, with examples and helpful tips. Whether you’re a student, beginner in finance, or just curious, you’ll find this easy and interesting!

What is the Cost of Equity?

The cost of equity is the return a company must give to its shareholders for investing in the business. It shows how much profit the investors expect for taking a risk by putting their money in the company.

Simply put, it’s the “price” a company pays for using someone else’s money without borrowing it.

Why is the Cost of Equity Important?

Knowing the cost of equity helps companies make smart decisions. It tells them how much profit they need to make to keep their investors happy. If the company can’t earn more than the cost of equity, investors might lose interest or sell their shares.

It also helps companies choose between borrowing money or selling shares. If the cost of equity is high, borrowing might be cheaper and better.

The Basic Cost of Equity Formula

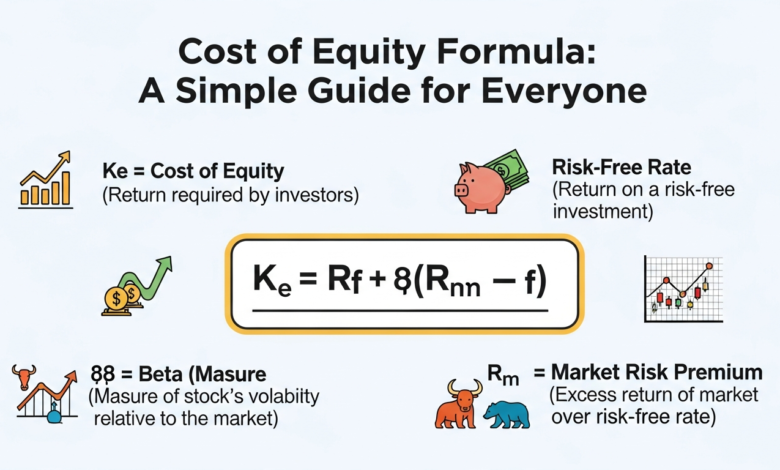

The most common cost of equity formula is the Capital Asset Pricing Model (CAPM):

Cost of Equity = Risk-Free Rate + Beta × (Market Return − Risk-Free Rate)

Let’s break it down:

- Risk-Free Rate: The safe return from a government bond.

- Beta: A number that shows how much the company’s stock price moves compared to the market.

- Market Return: The average return from the stock market.

This formula helps find the return investors want based on risk.

What is the Risk-Free Rate?

The risk-free rate is the interest rate you get from very safe investments like government bonds. Since these bonds have almost no risk, they are used as a baseline to measure other risks.

For example, if a government bond gives 3% return, this 3% is the risk-free rate in the formula.

Understanding Beta in the Cost of Equity Formula

Beta measures the risk of a company’s stock compared to the whole market.

- If Beta = 1, the stock moves like the market.

- If Beta > 1, the stock is riskier than the market.

- If Beta < 1, the stock is less risky.

Higher beta means investors want higher returns because the stock is riskier.

Market Return Explained

Market return is the average return investors expect from the overall stock market. It usually comes from stock indexes like the S&P 500.

If the market return is 8%, it means investors expect an 8% return on average from the market.

Example of Cost of Equity Calculation

Imagine:

- Risk-Free Rate = 3%

- Beta = 1.2

- Market Return = 8%

Using the formula:

Cost of Equity = 3% + 1.2 × (8% − 3%)

= 3% + 1.2 × 5%

= 3% + 6%

= 9%

This means the company needs to offer 9% return to its shareholders.

Other Methods to Calculate Cost of Equity

Besides CAPM, there are other ways:

- Dividend Discount Model (DDM): Uses dividends paid to shareholders and growth rate to find cost of equity.

- Earnings Capitalization Ratio: Uses company earnings and stock price.

Each method fits different company types and situations.

How Companies Use the Cost of Equity

Companies use cost of equity to:

- Make investment decisions.

- Set targets for profits.

- Decide how to fund projects.

- Value their stocks.

It is a key part of business planning and finance.

Factors Affecting Cost of Equity

Several things change the cost of equity:

- Changes in interest rates.

- Company risk (Beta changes).

- Market conditions.

- Investors’ expectations.

Understanding these helps companies stay competitive.

How to Lower the Cost of Equity?

Companies try to reduce risk to lower their cost of equity. Ways to do this include:

- Improving business stability.

- Reducing debt.

- Growing profits steadily.

- Building investor trust.

Lower cost means cheaper money for the company.

FAQs About Cost of Equity Formula

1. What does cost of equity mean?

It means the return a company pays to its investors for owning shares.

2. Why is cost of equity important?

It helps companies decide how much return to offer investors and guides financial decisions.

3. What is Beta in cost of equity?

Beta shows how risky a stock is compared to the whole market.

4. Can cost of equity be negative?

No, because investors always want some positive return for risk.

5. Is CAPM the only way to calculate cost of equity?

No, DDM and other methods can also be used.

6. How often do companies calculate cost of equity?

Usually when making big financial decisions or planning investments.

Conclusion: Understanding Cost of Equity is Key to Smart Investing

The cost of equity formula is simple but powerful. It helps companies know the price of using investors’ money. Learning this formula is useful for anyone interested in business, finance, or investing. By understanding the risk and expected returns, companies and investors can make better choices.

If you want to dive deeper, try calculating cost of equity for your favorite company! It’s a great way to learn how finance works in real life.